Investments

Over time, CIC has developed a total portfolio allocation management framework tailored to our institutional needs. This framework reflects our unique characteristics and investment philosophies, incorporates insights from academic and industry research, and establishes clear lines of authority and accountability.

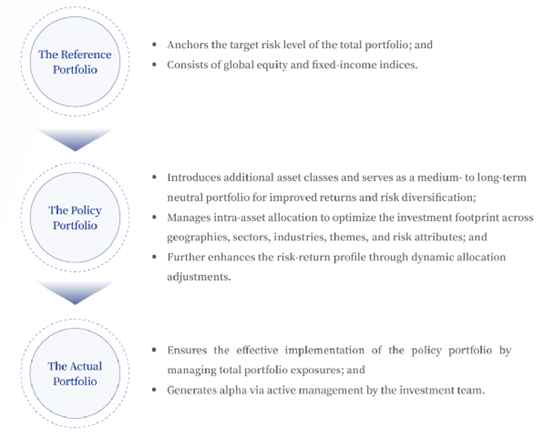

The company has adopted a portfolio construction framework that consists of a reference portfolio, a policy portfolio, and the actual portfolio. Under this framework, total portfolio returns are determined by reference portfolio selection, policy portfolio construction, and actual portfolio management.

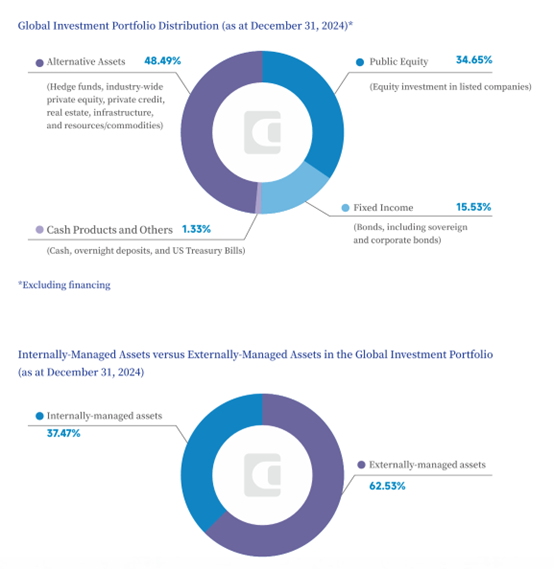

CIC has built a balanced, robust investment portfolio across different asset classes including public equities, fixed income, alternative assets, and cash products and others. In 2024, amid a complex market environment, we proactively refined our allocation management framework and strove to build a more resilient, higher-quality, and more sustainable “CIC Portfolio”.

In 2024, the global macroeconomic environment was marked by persistent high interest rates, high inflation, and deepening macro paradigm shifts. Geopolitical shifts intensified, financial markets remained turbulent, and growth divergences among economies widened, creating new challenges for overseas investment. Meanwhile, a new wave of technological and industrial transformation accelerated, with digitalization, decarbonization, and intelligent technologies injecting fresh momentum into global growth, creating new opportunities for investors.

In response, CIC remained strategically consistent and adhered to its identity as a long-term investor that operates on an international, market-oriented, professional, and responsible basis. The company optimized its investment models and capitalized on emerging opportunities. By strengthening integrated management and enhancing specialized capabilities, CIC refined its overseas investment and comprehensive risk management systems, optimized asset allocation and portfolio management, and continuously improved the resilience and quality of its total portfolio. In recent years, CIC's total portfolio performance has consistently exceeded its long-term absolute return targets, marking solid progress toward building a world-class sovereign wealth fund.

Agile and Controllable: Continuously Enhancing the Efficacy of Public Market Investments

CIC advanced precision management of public market investments by closely studying market trends and investment risks. It comprehensively reviewed strategy design, investment performance, and capability building to optimize investment positioning and further refine investment methodologies, thereby enhancing portfolio flexibility and adaptability.In public equities, CIC restructured its public equity portfolio to boost performance, and expanded proprietary investment with focused planning. It enhanced forward-looking analysis to capture thematic investment opportunities, while studying ways to optimize strategy structures in priority regions and sectors.

In fixed income and absolute return investments, CIC continued to adjust and optimize its bond portfolios, improved precision management of out-sourced portfolios, and enhanced its sovereign bond proprietary management capability. The company further refined its hedge fund investment methodology and built hedge fund portfolios better aligned with its allocation needs. It also conducted a comprehensive review of multi-asset risk allocation strategies to further optimize proprietary portfolios.

Proactive and Innovative: Optimizing Private Market Investment Models

CIC steadily advanced innovation in its private market investment models, deepening management of partnerships and expanding cooperation through co-investment platforms, customized accounts, and dedicated funds. It enhanced bilateral fund collaborations, strengthened deal pipeline development, and expanded research into key themes and regions to capture new opportunities.

In private equity and private credit, based on in-depth market analysis, CIC actively pursued thematic investment opportunities, particularly in priority industries, while expanding co-investment partnerships. Balancing market opportunities and performance targets, it maintained a steady investment pace, optimized portfolio structure, and strengthened coordination between private equity and private credit to capture attractive risk-adjusted returns in a high-yield environment. The company also reinforced comprehensive risk management and advanced post-investment adjustments and deal exits.

In real estate, CIC focused on enhancing portfolio resilience against inflation and economic cycles. It targeted regions with strong growth potential, deepened partnerships with top-tier managers, advanced co-investment models, emphasized post-investment value creation, and optimized distribution across business formats and geographies.In infrastructure, CIC steadily increased investment in priority regions to promote connectivity, explored more effective cooperation models, and strengthened post-investment management of key projects while maintaining strict risk control.

In sustainable energy, CIC aligned with the Dual Carbon Goals and strengthened energy transition investments by deepening industry coverage, broadening investment scope, and enhancing macro policy and market analysis. The company also optimized traditional energy portfolios and advanced post-investment management and risk mitigation.

In bilateral funds, the company maintained a prudent investment pace, deepened country specific expertise, and tapped industrial synergies. We leveraged China's market to enhance growth of invested companies and boost returns, and drove high-quality investment and industry partnerships.

Overseas Offices: Leveraging Synergies to Support Business Development

CIC International (Hong Kong) has continued to play a key role in supporting the company's business. In public markets, it adheres to the positioning of a long-term investor, consistently refines investment processes, develops mature and robust investment philosophies and methodologies, and prudently manages portfolio risks, while leveraging Hong Kong's geographic and informational advantages to capture global and regional opportunities. In private markets, it focuses on the Guangdong–Hong Kong–Macao Greater Bay Area while extending into the broader Asia-Pacific region, actively assisting investment teams at the headquarters with deal sourcing and post-investment management, achieving effective collaboration. In research, it provides high-quality macro-strategy analysis that supports the company's investment decision-making.

The New York Representative Office serves as a crucial link for communication, outreach, and support. It actively engages with local peer s and business partners, studies economic and investment market trends, and provides in-depth market insights. The office supports investment teams at the headquarters with post-investment management and on-site due diligence for deals across the Americas.

The London Representative Office was officially registered in December, 2024. It has since advanced the company's overseas investment business by facilitating communication, conducting research and analysis, and supporting deal sourcing, due diligence, and post-investment management. The office has enhanced engagement with local institutions and promoted cross-border investment cooperation.

CIC is a long-term institutional investor with a 10-year investment horizon that applies annualized rolling returns as its key performance metric.

As at December 31, 2024, CIC's annualized cumulative 10-year net return stood at 6.92%, beating the 10-year performance target by 61 basis points. Its annualized cumulative net return since inception stood at 6.39%. The above figures are USD-based.

Investment Performance on the Global Portfolio (all measured in US$)

a. Net cumulative annualized returns and the annual return for 2008 are calculated since inception on 29 September 2007.