Investments

Objective and Approach

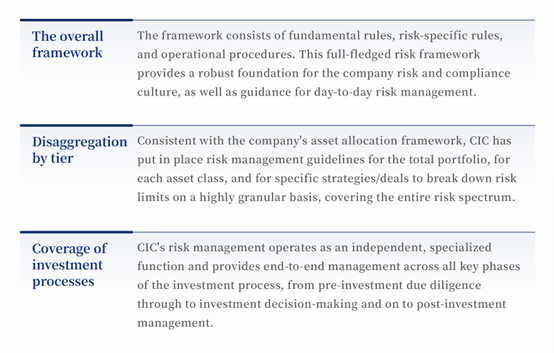

The objective of risk management is to put in place effective policies, mechanisms, systems, and processes for investment and operations to maximize the returns for the shareholder within an acceptable risk tolerance.

Risk management is a company-wide effort involving every business line, department, and individual. It is embedded throughout the investment life cycle, from the overall portfolio to general asset classes and to specific investment strategies and sub-strategies.

Risk Governance

At the decision-making level, the company further improved its risk management governance framework by establishing a Risk Management Committee under the Board of Directors, a Comprehensive Risk Management Committee under the Executive Committee, and three subcommittees focusing on different business areas. These committees have played an important role in guiding and supervising investment activities and have continuously enhanced their specialization in risk oversight.

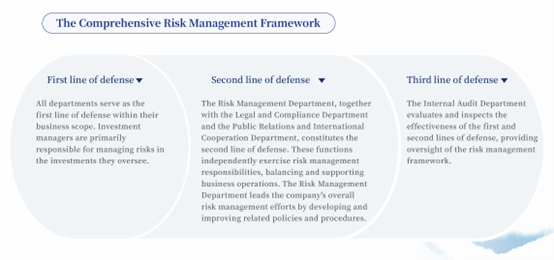

At the execution level, CIC rigorously enforces its “three lines of defense” under a multitiered, pan-asset class, and whole-process risk management framework.

Risk Response

The company has continued to refine its risk management system, strengthen the counterbalancing role of risk oversight within investment activities, and harmonize risk management efforts across business segments. Our comprehensive framework covers twelve key risk categories: market, credit, operational, legal and compliance, reputational, geopolitical, information technology, integrity, climate risks, etc. We have continually refined risk management tools across multiple levels, from total portfolio to individual asset classes and specific portfolios or deals. These enhancements have bolstered our risk monitoring and management capabilities, keeping investment activities within defined risk tolerance.

Market Risk Management

Based on the company's risk appetite and tolerance, we established prudent risk budgets, monitored portfolio-level risk utilization, and evaluated risk-adjusted returns. We carried out special studies on key investment risks, and continuously refined risk indicators and reporting systems to better serve investment management.

Credit Risk Management

Our Sovereign Credit Risk Report provided regular analysis of global sovereign credit risk trends. We optimized our sovereign credit rating model, updated sovereign credit scores of countries and regions covered, and broadened the applications of sovereign risk modeling. We also performed timely counterparty credit risk evaluations and continuously monitored credit risk developments across our portfolios.

Operational Risk Management

We enhanced requirements for investment due diligence and post-investment management and dynamically updated pertinent rules and procedures. Our authorization management framework was optimized, and implementation evaluations were strengthened. We strictly enforced accountability for financial risk management, and enhanced risk resolution mechanisms with well-defined responsibilities. We also refined the operational risk management framework, and enhanced assessment and monitoring.

Legal and Compliance Risk Management

With a focus on prudence and compliance, we strictly adhered to domestic and host country regulatory requirements, actively preventing legal and compliance risks in overseas investment. Compliance inspections were strengthened, and the legal risk management framework was fortified.

Reputational Risk Management

In line with company policies, we enhanced our reputational risk management processes, improving mechanisms for identification, assessment, response, reporting, and coordination. These efforts reinforced our standing as a responsible corporate citizen and respected partner.

Integrity Risk Management

We carried out targeted governance campaigns on integrity-related issues and reinforced oversight of overseas operations. We assessed and updated the Integrity Risk Management Manual, with revised risk level assessments and enhanced control measures.

Geopolitical Risk Management

We refined our frameworks for assessing and monitoring geopolitical risks, improved consultation mechanisms, and closely tracked developments across major geopolitical events.

Information Technology Risk Management

We comprehensively assessed security vulnerabilities in data, software, hardware, and systems. We systematically enhanced our data protection and network security defenses.

Climate Risk Management

We closely followed new developments in climate scenarios. Building on established frameworks and tools, we explored methodologies for quantifying climate risks and advanced the development of a climate risk assessment system.